This Iconotech video looks at the cost savings if you switch from pre-printed case inventories to generic case inventories. If you’ve identified slow-moving inventory, the first step is to notify your team that there’s a concern with that inventory item. That way no one will accidentally order more or fail to take action on a sales plan.

It would be great to link the average monthly usage, especially for companies with seasonality, or the corresponding sales value, so that we can calculate the metrics we discussed. Remember that your ERP or accounting software might have a more complicated process in place, but the operations’ essence will be the same. Also, make sure you confirm the process with your local tax authorities, as there may be some requirements or limitations. Retaining Obsolete inventory only makes sense if future gross profits cover the accumulated holding costs. To get a more detailed and actionable insight, we can separate our stock into groups of similar items. And this is critical, especially if we have both materials and produced goods.

Supply Chain Management

By examining a company’s level of obsolete inventory, we have an idea of how well its goods are selling. Dead inventory warns investors that the company may have poor inventory management, second-rate products, or inaccurate management forecasts of demand. During 2020 and 2021, significant supply chain issues caused lead times to vary wildly and caused problems for businesses all over the country — and the world.

These factors all can contribute to the accumulation of obsolete inventory and can hurt their revenue. This includes inaccurate conjectures of consumer demands, low-quality production or marketing, fast-paced industry advancements and outdated or inadequate inventory systems. A final source of information is the preceding period’s obsolete inventory report. The accounting staff should keep track of these items and notify management of those for which there is no disposition activity. As noted earlier, forecasting is key to striking the right balance with inventory.

Benefits of Disposing of Obsolete Inventory

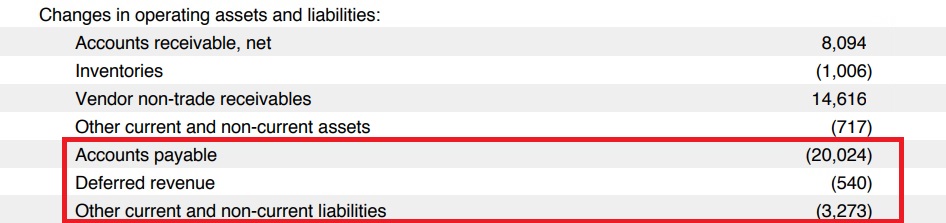

The journal entry removes the value of the obsolete inventory both from the allowance for obsolete inventory account and from the inventory account itself. A write-down occurs if the market value of the inventory falls below the cost reported on the financial statements. A write-off involves completely taking the inventory off the books when it is identified to have no value and, thus, cannot be sold. Ecommerce merchants can now leverage ShipBob’s WMS (the same one that powers ShipBob’s global fulfillment network) to streamline in-house inventory management and fulfillment. With real-time, location-specific inventory visibility, intelligent cycle counts, and built-in checks and balances, your team can improve inventory accuracy without sacrificing operational efficiency.

- You can also target new customer segments by exploring niche markets or demographics that may have been previously overlooked.

- Real-time access to data across the supply chain is beneficial for real-time inventory management.

- At the end of an accounting period or fiscal year, the unsellable inventory must be reported on as an inventory write-off in accordance with the Generally Accepted Accounting Principles (GAAP).

- It can include outdated parts, components, or materials no longer used in production.

- Put simply; the term refers to items that are either impossible or very difficult to sell.

Perhaps an item breaks easily or doesn’t work as advertised, due to either a design oversight or a mistake in the manufacturing process. Customers may return these items—a problem in itself—and leave negative reviews. Similarly, a new item that has no advantage over similar products already on the market could underperform and result in excess inventory. Additionally, minimizing obsolete inventory makes it easier for companies to put together accurate financial statements and get a clear picture of their current inventory carrying costs. There are fewer chances for bookkeeping errors or to overlook excess inventory sitting in a dusty corner of the warehouse.

Fill out the form below to see Clear Spider’s Vaccine Management System live!

The third step to handle inventory obsolescence and excess inventory is to dispose of the inventory items that are no longer needed or profitable. Depending on their condition, value, and marketability, there are different ways to do this. You can try selling or donating them to other businesses, charities, or customers for a discounted price or tax benefits. If possible, you can also return them to the suppliers or manufacturers for a refund, credit, or exchange. Recycling them into new products or materials may be feasible in order to reduce environmental impact and generate revenue.

Slow-moving and obsolete Inventory can have a severe adverse effect on the profitability of the business. When we can’t realize our goods on hand, they lose value and may become useless for the company. Oftentimes, technological innovations make products outdated or undesirable, because they don’t offer the latest features or design capabilities. There may be cases when you may decide to hang onto excess or even obsolete items. The burden of file maintenance can be an obstacle in using advanced inventory calculations to keep inventory at the correct levels.

With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. They need to understand how long after they place an order they will actually receive products, which could vary among vendors. Extended lead times, especially if they’re longer than expected, can be especially problematic because demand for a product could drop in the months that pass before an organization receives the goods. Because obsolete inventory can lead to major cash flow problems, it can hurt a business’ ability to weather a rough patch.

Reasons to avoid obsolete inventory

Because any inventory left on hand must be written off as a loss, you can at least sell them to cover the cost of goods sold and not have to take a loss. Using social media platforms, email newsletters, and other forms of free promotion, market your flash sale on the recess inventory to the tune of “everything must go” and hope you can kill two birds with one stone. Katana’s software automates and streamlines the entire inventory management process, giving you visibility into your inventory levels in real time. This allows you to identify which products are becoming obsolete and take steps to prevent them from clogging up your warehouse space. Sometimes, retailers are left holding excess stock because they didn’t follow the movement of their stock through the supply chain closely enough.

On the other hand, reducing obsolete inventory can boost a business’ financial health. It lowers overall inventory costs and the losses that come with writing-off this stock. Not wasting money on obsolete inventory frees up cash the company can invest in other areas to help it succeed.

Instead, obsolete inventory can be remarketed, sold as a discount, or donated to charity. Regardless of seasonality, the analysis of the trend reports is the critical activity to identify slow-moving inventory, before it crosses the line and becomes hard-to-move excess inventory. In this example, the total cost of the obsolete stock is $4.450, which represents 10.7% of the total inventory. You must track this particular KPI weekly to ensure it is reduced over time.

The way to avoid this is by giving every department access to information like purchase and sales orders. This means the warehouse team working with the purchasing team and the purchasing team working with the receiving team. Likewise, the inhouse teams should be working in tandem with suppliers and shippers. When it comes to omnichannel sales — sales from several different online platforms and physical stores — keeping tabs on the level of inventory that needs to be held is complex but vital. Every sales channel is different, and a product that does well on one may not sell on another.

Below, we’ll look at an obsolete inventory definition, the causes of obsolete inventory, and strategies for managing it. Allison Champion leads marketing communication at Flowspace, where she works to develop content that addresses the unique challenges facing modern brands in omnichannel eCommerce. She has more than a decade of experience in content development and marketing. Optimize the receipt, stock, pick and shipment of products with barcoding. Finale helps sellers prevent stock-outs, more profitably grow their business and streamlines warehouse workflows. Minimizing both is a function of inventory best practices and analysis techniques.

While small businesses could hold onto these items until the season rolls around again, doing so can be costly and limits cash flow. If a competitor offers a higher quality or more affordable product, you can bet that most customers will stop purchasing from one company and turn to the more appealing option. This can leave a small business with obsolete products that are unsellable.

- One of the main culprits of slow-moving, excess, and obsolete inventory is buying more than you can sell.

- Once inventory becomes obsolete, your options for disposal become very limited so catching an inventory problem when it still has some value is very important.

- Whenever we have identified dead stock, it’s best to deal with it straight away, so it no longer hurts the business with holding costs and tied up cash.

- An inventory write-off can help you reduce your tax liability, which involves taking the inventory off the books when it is identified to have no value and, thus, cannot be sold.

You can adjust this ratio with outside factors that may affect the product’s sales, including season, location and past sales history. When a product is becoming obsolete, there are two accounting processes that companies must use to track the value of their inventory. An inventory write-down occurs when the market value of your inventory drops below its initial price range. To handle this, you can either markdown your product or write it off completely. An inventory write-off happens when you formally acknowledge that part of your inventory no longer has value. Inventory management is a necessary part of business, and you should not solely rely on digital software to track your inventory.

Another Board policy should state that management will actively seek out and dispose of work-in-process or finished goods with an unacceptable quality level. By doing so, goods are kept from being stored in the warehouse in the first place. Not only is this much preferred to disposing of the items, but it can make organizations eligible for a tax deduction equivalent to the cost of those products. This option is more relevant for retailers and distributors that sell finished goods, rather than manufacturers or suppliers that work with raw materials.

Planning for Disruption: Supply Chain Strategy for Small-to-Mid-Size … – Thetecbiz

Planning for Disruption: Supply Chain Strategy for Small-to-Mid-Size ….

Posted: Tue, 08 Aug 2023 22:00:00 GMT [source]

You should also test the adequacy and appropriateness of the client’s provisions and write-offs for inventory obsolescence and slow-moving items, and check that they are recorded and disclosed correctly. A write-down is a standard accounting obsolete inventory journal entry used to record the value of the old stock. This write-down is typically done when a company has certain products that are no longer useful and will not be sold. But to move the product faster and get more cash for it, the company decided to bundle the product with two best-selling wines, a red and a white.